A monthly paycheck best represents a cornerstone of financial stability, a beacon of hope for individuals and families navigating the complexities of modern finance. It provides a steady stream of income, empowering individuals to plan for the future, manage debt, and pursue their financial goals with confidence.

This article delves into the multifaceted role of a monthly paycheck, exploring its significance in various aspects of financial well-being, from budgeting and saving to debt management and retirement planning. Through a comprehensive analysis, we uncover the ways in which a regular income stream serves as a foundation for financial security and empowerment.

Financial Security

A monthly paycheck is a cornerstone of financial security. It provides a regular and predictable income that allows individuals and families to plan their finances, build savings, and prepare for the future.

With a steady income, individuals can establish a budget, allocating funds for essential expenses such as housing, food, and transportation. This helps them avoid overspending and ensures that they have sufficient resources to meet their basic needs.

Additionally, a monthly paycheck enables individuals to save for emergencies and long-term goals. Regular savings contribute to a financial cushion that can be used to cover unexpected expenses, such as medical bills or job loss.

Planning and Budgeting

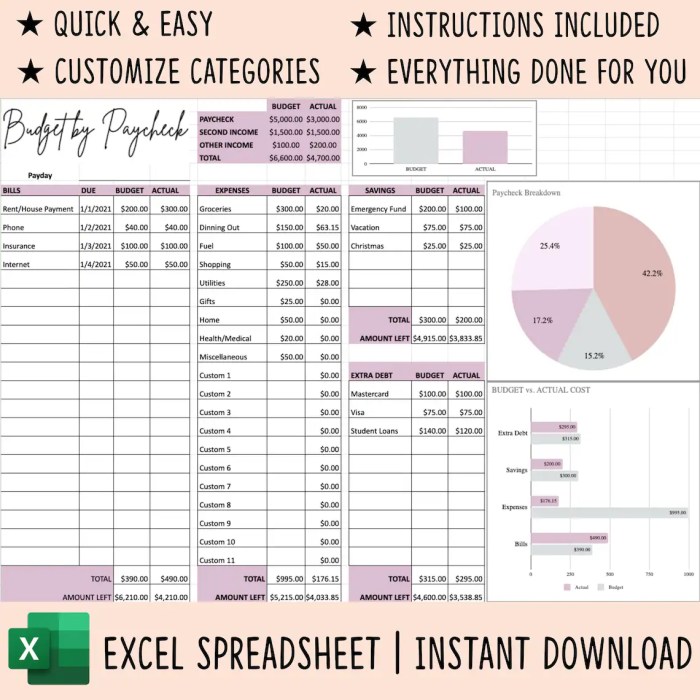

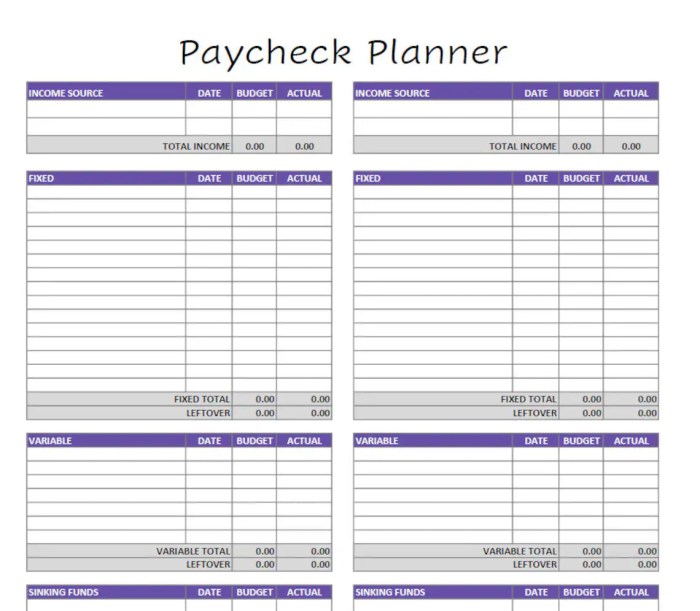

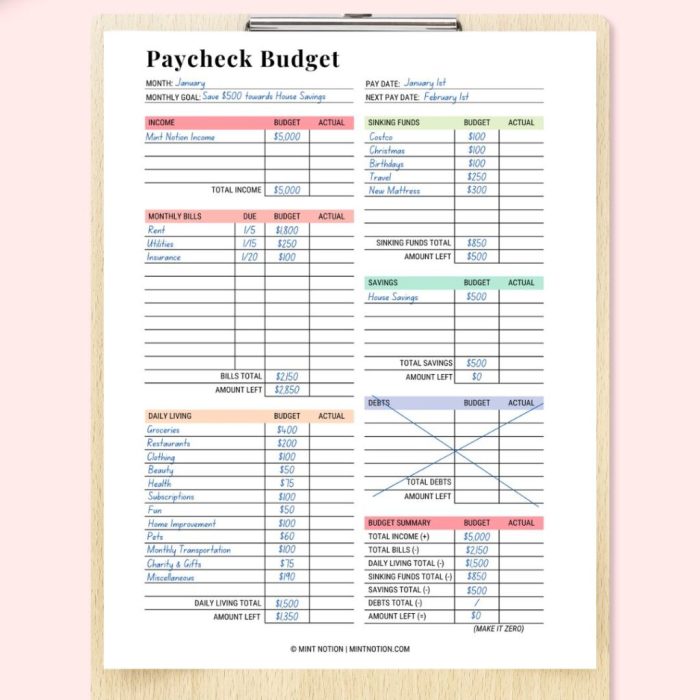

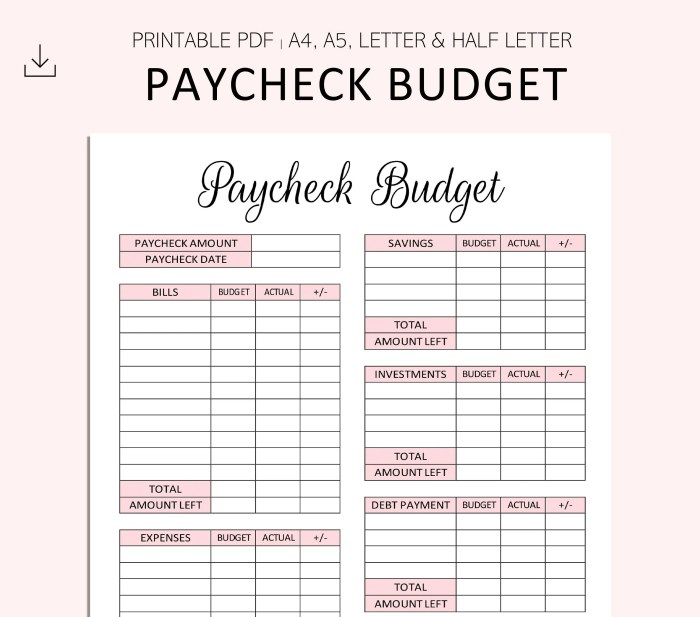

Effective budgeting is crucial for managing finances with a monthly paycheck. A budget helps individuals track their income and expenses, ensuring that they are living within their means and allocating funds wisely.

A sample budget may include categories for essential expenses (housing, food, transportation), savings, and discretionary spending (entertainment, dining out). By adhering to the budget, individuals can avoid debt and build financial stability.

Budgeting tools and apps can simplify the process and provide insights into spending patterns. These tools can automate transactions, track expenses, and generate reports that help individuals make informed financial decisions.

Debt Management

A monthly paycheck can empower individuals to manage debt effectively. By prioritizing debt payments and allocating a portion of their income towards debt reduction, they can gradually reduce their overall debt burden.

Creating a debt repayment plan is essential. This plan should Artikel the order in which debts will be paid off, taking into account interest rates and minimum payments. By sticking to the plan, individuals can reduce debt and improve their financial standing.

Retirement Planning, A monthly paycheck best represents a

A monthly paycheck can contribute significantly to retirement savings. By starting early and maximizing retirement contributions, individuals can secure a comfortable retirement future.

There are various retirement savings options available, such as 401(k) plans, IRAs, and annuities. Each option has its own benefits and drawbacks, and individuals should consider their financial situation and retirement goals when selecting the right option for them.

Financial Goals

A monthly paycheck can help individuals achieve their financial goals. By setting specific, measurable, and achievable goals, individuals can create a roadmap for their financial future.

Regularly tracking progress towards financial goals is essential. This allows individuals to make adjustments as needed and stay motivated in pursuit of their objectives.

Discipline and staying motivated are key to achieving financial goals. Individuals should develop a financial plan that aligns with their values and priorities, and they should be willing to make sacrifices and adjust their spending habits to reach their goals.

Detailed FAQs: A Monthly Paycheck Best Represents A

What is the significance of a monthly paycheck?

A monthly paycheck provides financial stability, allowing individuals to budget, save, and plan for the future. It serves as a foundation for managing debt, contributing to retirement savings, and achieving financial goals.

How does a monthly paycheck contribute to financial stability?

A monthly paycheck provides a steady stream of income, reducing financial uncertainty and enabling individuals to make informed decisions about their finances. It facilitates budgeting, saving, and planning for unexpected expenses or emergencies.

What are some tips for effectively budgeting with a monthly paycheck?

To effectively budget with a monthly paycheck, allocate funds to essential expenses first, such as housing, food, and transportation. Then, set aside a portion for savings and discretionary spending. Consider using budgeting tools or apps to track expenses and stay on track.